All you have to do is divide the number 1 by the useful life of the asset and multiply it by the cost of the asset. So today we talk about what is the percentage is used on different fixed assets as per the given Depreciation chart as per Income Tax Act for FY 2012-13.

Dynamics 365 For Finance And Operations Fixed Asset Posting Using Do Not Allow Manual Entry And Posting Validation

After the completion of its useful life the machine can be sold for 50000.

. As per companies act 2013 Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life where the. Depreciation chart as per Income Tax Act for FY 2012-13 and AY 2013-14. Now the amount of depreciation is Rs.

Clause 1 of section 43 defines the actual cost of fixed assets for the purpose of claiming depreciation. An entity using the cost model for investment property in accordance with MPSAS 16. Although the straight-line method of depreciation writing assets off at a fixed per year on the original cost price and the book value method of depreciation writing assets off at a fixed based on the latest book value of the assets in the Balance Sheet are popular methods of depreciation there are other methods also available.

We have a requirement to calculate Tax Depreciation for Malaysia with reference to the Capital AllowanceThe scenario is like this. During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business. Rate of depreciation applicable on the asset is 14.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. Need to find the total depreciable value of an asset Say a machine is purchased for 200000. Annual Depreciation Cost of Assets 100 but the formula for calculating annual depreciation is a bit different.

And then this rate is multiplied with the production of every period to get the depreciation expense. So the depreciable value is Depreciable Value Purchase price Salvage Value Depreciable Value 200000 50000 Depreciable Value 150000. MPSAS 17 -Property Plant and Equipment 1.

Depreciation is the amount which is deducted from the fixed assets annual on a specified percentage. In one line no depreciation as per Income Tax Act will be allowed if an asset is acquired in cash. The formula to calculate.

Accounting treatment for these assets including depreciation are prescribed by this Standard. Section 179 deduction dollar limits. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

In this method the formula to calculate the depreciation rate would remain the same ie. This rate under this method will be fixed throughout the whole life asset. 28000 for every year.

10000 to claim depreciation. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

Under this method the rate of depreciation will be applied on the written down value of. GOVERNMENT OF MALAYSIA Malaysian Public Sector Accounting Standards MPSAS 17 Property Plant and Equipment March 2013. Depreciation refers to the decrease in value of an asset over a period of time.

The depreciation rate under this method is calculated by dividing the total cost of an asset by the estimated production capacity of the asset. The Income Tax Act 1962 has made it mandatory to calculate depreciation. 1 SCHEDULE II 2 See section 123 USEFUL LIVES TO COMPUTE DEPRECIATION.

For Asset Class say Office Equipments Initial Allowance is 20 and Annual Allowance is 10 That means depreciation will be calculated 20 on the acquisition value immediately upon acquisition for one time. While annual allowance is a flat rate given. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Depreciation under Companies Act 2013. Capital allowances consist of an initial allowance and annual allowance. Before knowing the Depreciation Rate as Per Companies Act for AY 2022-23 we must know the meaning of depreciationIn simple words depreciation is a reduction in the value of assets over time due in particulars to wear and tear.

Whereas the second proviso to section 431 made disallowance of depreciation where cash payment is exceeding Rs.

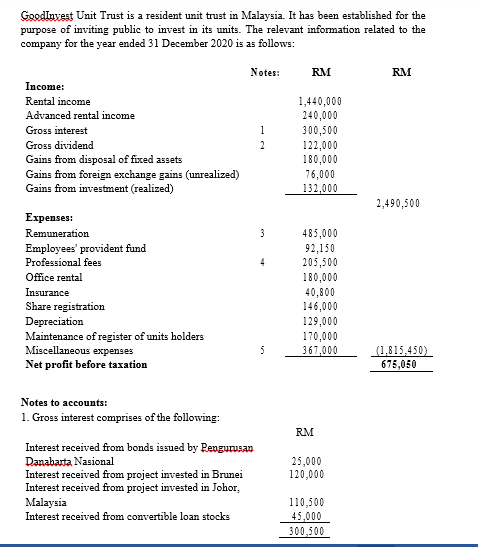

Goodinvest Unit Trust Is A Resident Unit Trust In Chegg Com

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano

Disposal Of Fixed Assets Label On Notepad With Laptop And Smartphone On Wooden Table Business Concept Stock Photo Alamy

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano

Dynamics 365 For Finance And Operations Fixed Asset Posting Using Do Not Allow Manual Entry And Posting Validation

Disposal Of Fixed Assets Label On Notepad With Laptop And Smartphone On Wooden Table Business Concept Stock Photo Alamy

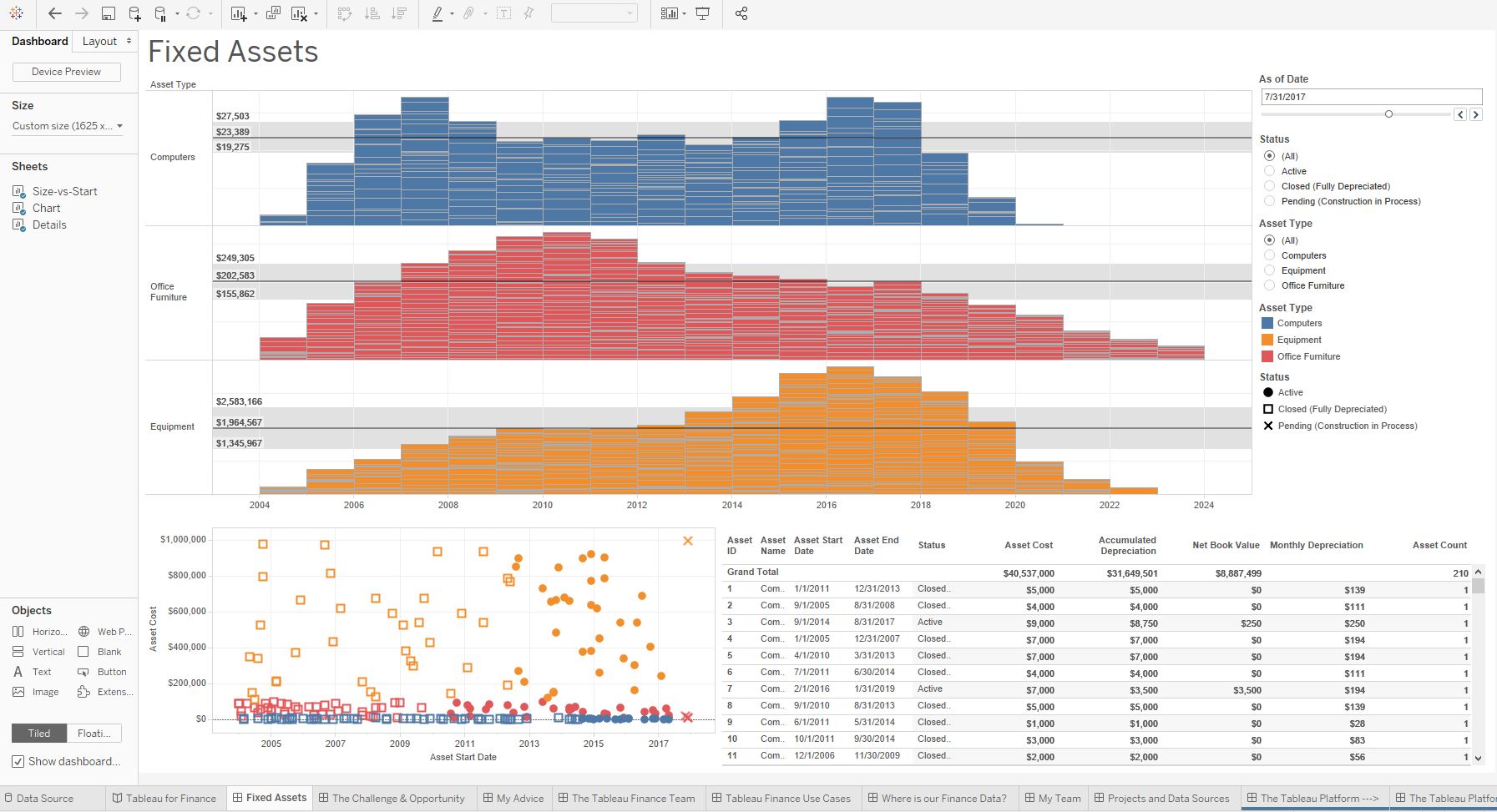

The Price Is Right The Art Of Visualizing Finance Data

How A Better Fixed Asset Depreciation Process Saves Money Sage Advice United Kingdom

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano

Fixed Asset Reconciliation The Purpose And Use Trc Consulting

Dynamics 365 For Finance And Operations Fixed Asset Posting Using Do Not Allow Manual Entry And Posting Validation

Depreciation Schedule Template For Straight Line And Declining Balance

Training Modular Financial Modeling Historical Forecast Model Forecasts Fixed Assets Modano